The pandemic has profoundly impacted the commercial real estate industry, causing significant challenges across all asset classes. Retail real estate, in particular, has faced uncertainty and disruption. However, despite current lending challenges in commercial real estate, strip centers are emerging as a favored asset class. One reason is their resilience.

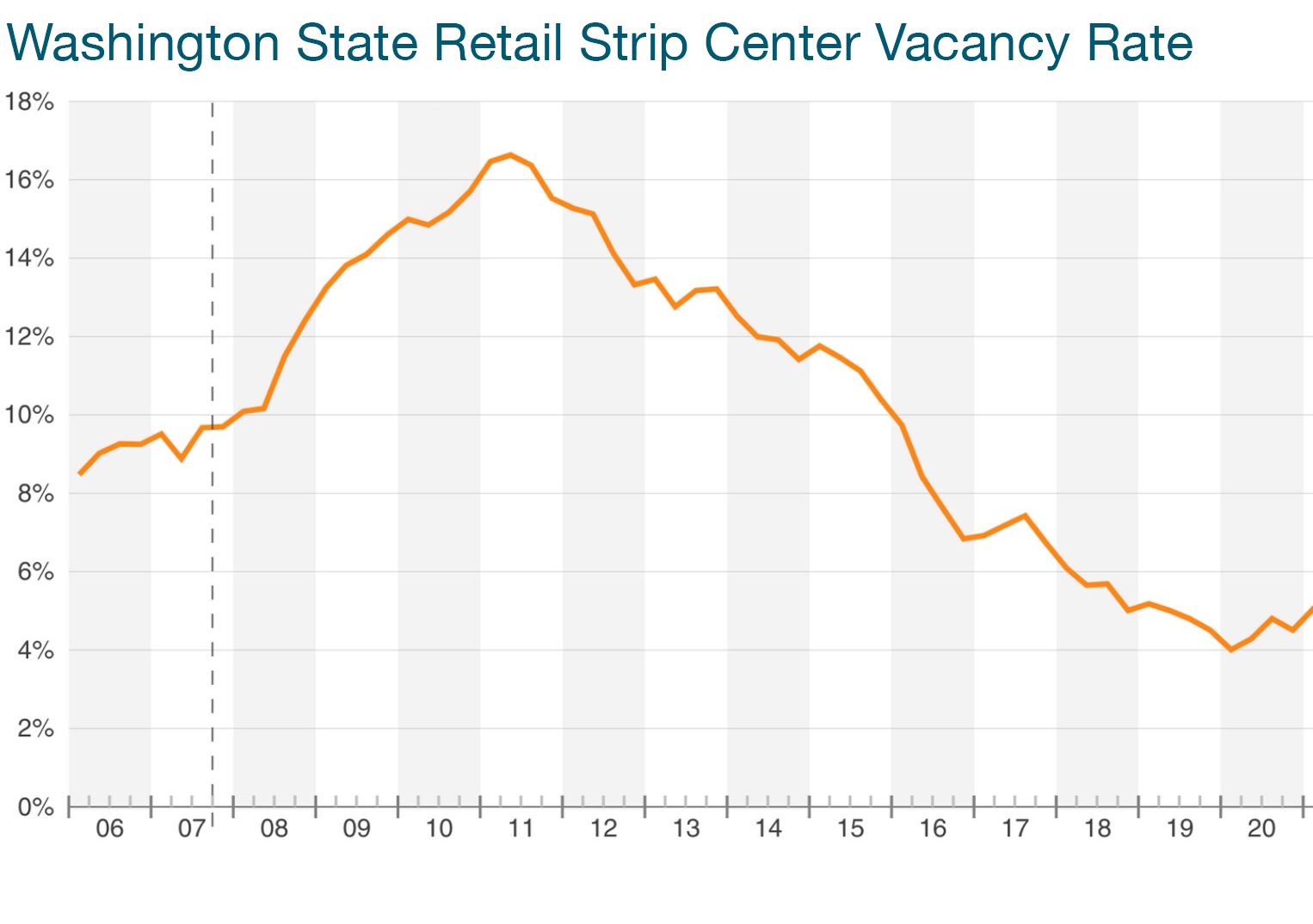

To understand the current state of strip retail centers in Washington, our team conducted a survey of 768 non-owner user properties that were built after 1980 and are 5,000 square feet or larger without an anchor tenant. The results of our survey showed that strip centers have a current vacancy rate of 3.7%. While this is slightly up from the historic low of 3.2% in Q4 2020, it is still far from the peak of 16.6% during the Great Financial Crisis in Q2 2011.

It is important to note that the current economic headwinds are expected to cause retail vacancy rates to continue to increase. Despite this, retail rates remain healthier than alternative asset classes.

The vacancy data demonstrates the reliability of strip retail. With the current occupancy rates showing consistent strength, investors can have confidence in it’s ability to provide stable returns and potential for future growth.