What we’re tracking

The Fed is expected to raise the federal funds rate by 50 basis points at their meeting tomorrow. Another 0.5% to 0.75% hike is expected on June 15th.

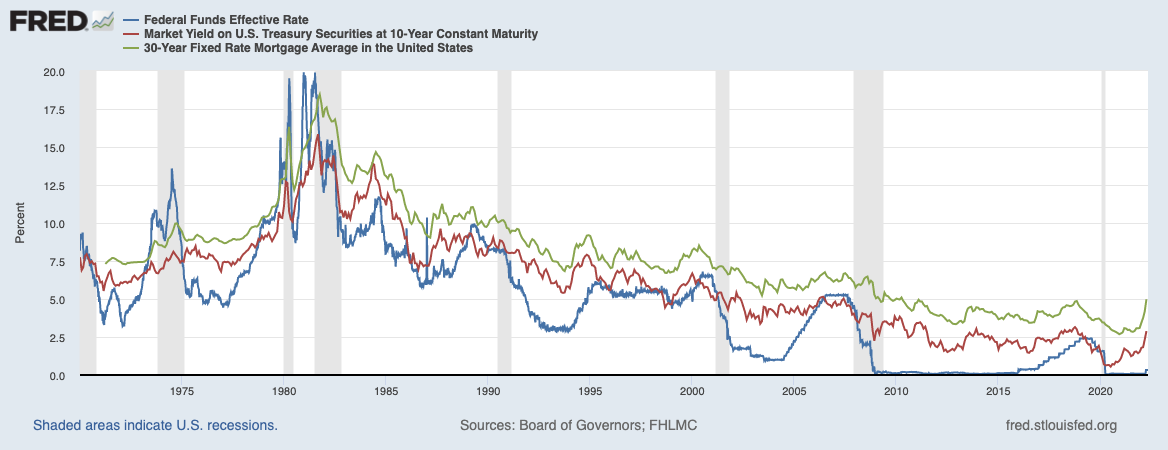

We’ve heard the argument that interest rates are not directly tied to the federal funds rate. Technically true, but take a look at the following chart which shows the effective federal funds rate, 10-year treasury, and 30-year fixed rate mortgage rates over the last 50 years. There is a strong correlation. Expect interest rates to continue to rise as long as the Fed continues to raise the federal funds rate.

A few things worth noting.

- Markets respond to increases in the federal funds rate faster than decreases. Rates rise quickly and can be slow to recover.

- Lender spreads typically narrow as the federal funds rate goes up.

What we’re reading

- US Commercial Real Estate Sales Motor on in First Quarter

- U.S. commercial property sales climbed at double-digit rates from a year ago in Q1 2022 despite the uncertainty around war, interest rates and inflation. Sales activity in the first quarter increased 56% on the same period a year ago and in March activity increased 47% from a year prior, the latest edition of US Capital Trends shows.

- Retail volume, off to its strongest start since 2017, totaled $18.6 billion in the quarter, more than double than at the start of 2021. Cap rates continue to fall, though pricing stalled in Q1. While pricing is up 16.3% over the past 12 months, quarterly gains were just 0.4%. The U.S. consumer remains strong, with wage gains and low unemployment. However, persistent inflation is showing signs of weighing on discretionary spending, which may cause retail investment to stall. In the largest deal in March, EDENS purchased an eight-property portfolio in California and Washington, totaling 1.2 million square feet, for an estimated $577 million.

- Shops at Burlington Fashion Outlets Sell for $9.5M for Redevelopment

- We recently sold the Shops at Burlington, a 185,230-square-foot outlet center. Most investors we spoke with were familiar with the property and many had visited the outlet center over the course of its 30-year existence. It is hard to miss the 19-acre property fronting Interstate 5.

- The majority of the interest was from multifamily developers with mixed-use development plans. We had numerous competitive offers and closed with an all-cash buyer on a short timeline.

On our calendar – ICSC 2022

Planning to attend ICSC in Vegas this year? We’ll be there and would appreciate the chance to catch up. Please click here to schedule a meeting with us.

We will also be hosting a happy hour on Monday, May 23rd. Please reach out if you would like to join.